Introduction:

When NRIs remit money from India, it is essential for them to comply with the regulations set forth by the Foreign Exchange Management Act (FEMA). One of the key compliance requirements is filing Form 15CA and obtaining Form 15CB. In this blog post, we will delve into the significance of Form 15CA and 15CB, why NRIs need them, and how Manisha Mohol and Associates assist NRIs in fulfilling these requirements.

- Understanding Form 15CA:

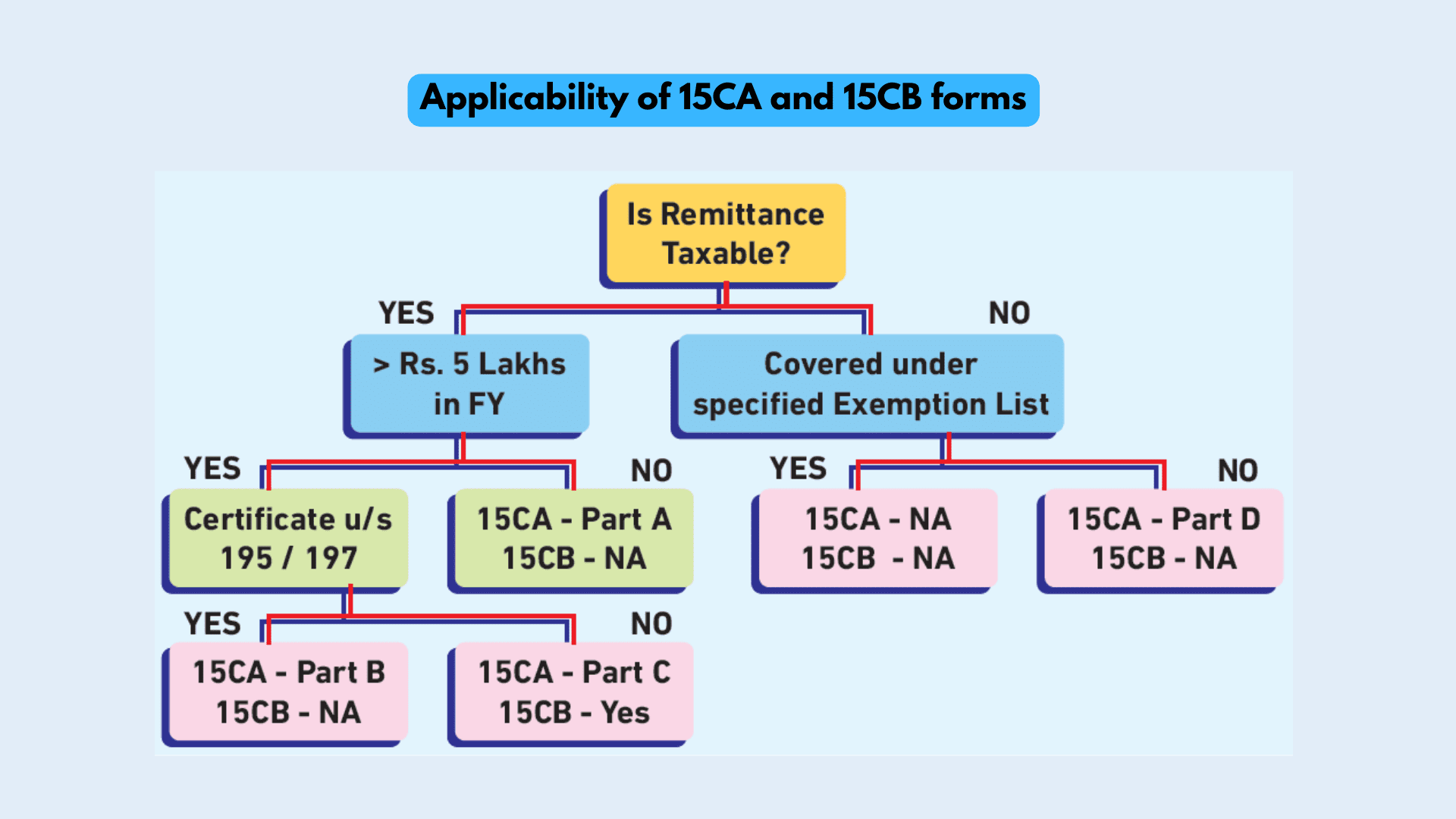

Form 15CA is an online declaration that needs to be filed by NRIs while making remittances from India. It is a self-declaration form used to furnish information about the nature and purpose of the remittance. The form helps in monitoring and regulating foreign remittances to ensure compliance with FEMA regulations. - Exploring Form 15CB:

Form 15CB, on the other hand, is a certificate issued by a Chartered Accountant. This certificate verifies that the remittance made by the NRI is in accordance with the provisions of FEMA. It includes details such as the purpose of remittance, taxability of the income, and adherence to transfer pricing regulations, if applicable. - Importance of Form 15CA and 15CB for NRIs:

NRIs are required to file Form 15CA and obtain Form 15CB to ensure transparency and compliance with FEMA regulations. These forms help the Indian tax authorities track foreign remittances and verify if the remittance complies with the applicable tax and regulatory provisions. Filing these forms also assists in preventing tax evasion and maintaining financial integrity. - Role of Manisha Mohol and Associates:

Manisha Mohol and Associates specialize in assisting NRIs with the filing of Form 15CA and 15CB. Their team of experts verifies the purpose of the remittance and ensures that all necessary documents and information are correctly provided. By facilitating the compliance process, the firm helps NRIs navigate the complexities of FEMA regulations and ensures smooth remittance transactions.

Conclusion:

Form 15CA and 15CB play a vital role in the compliance process for NRIs remitting money from India. These forms help the tax authorities monitor and regulate foreign remittances, ensuring adherence to FEMA regulations. Manisha Mohol and Associates offer professional assistance to NRIs in filing Form 15CA and obtaining Form 15CB, ensuring compliance and streamlining the process. By availing the services of experienced professionals, NRIs can fulfill their obligations while efficiently managing their remittance transactions.

When it comes to reporting payments made to non-residents, Indian taxpayers rely on two important forms: Form 15CA and Form 15CB.

These forms play a crucial role in ensuring compliance and transparency in international transactions.

Form 15CA: This form is to be submitted by the person making the payment to a non-resident or foreign company, when tax on that payment has to be paid in India. It acts as a declaration of the payment and must be submitted before the actual payment is made.

Form 15CB: On the other hand, Form 15CB is a certificate provided by a qualified Chartered Accountant. This certificate accompanies Form 15CA and confirms that the details provided in Form 15CA are accurate and in line with the applicable tax regulations.

To promote accurate reporting and compliance, it is important for Indian taxpayers to understand the significance of these forms. By submitting Form 15CA and obtaining Form 15CB from a trusted chartered accountant in Ponda, Goa, taxpayers can ensure that their international transactions are properly documented and adhere to the relevant tax provisions.

If you’re engaging in transactions with non-residents, it’s advisable to consult with a local tax professional or chartered accountant who can guide you through the process and help you navigate the complexities of Form 15CA and Form 15CB. You may speak to an expert on this by calling 9527938138 in India.

Remember, staying compliant not only helps you fulfill your tax obligations but also contributes to a transparent and trustworthy business environment

Form 15CA and CB can be filed online or offline.

To file these forms you require help of an expert Chartered Accountat in Goa. You may call 9527938138 to speak to an expert regarding this.,

To file Form 15CA and CB online, you can use the e-filing portal of the Income Tax Department. To file Form 15CA and CB offline, you can submit the forms to any of the following:

>> Your nearest income tax office

>> A chartered accountant

>> A post office

Failure to file Form 15CA and Form 15CB can result in penalties and other serious consequences as per the regulations set by the Income Tax Department in India.

Penalty: Non-filing of these forms may attract a penalty of ₹200 per day for each day the forms are not filed, with a maximum penalty of ₹10,000.

Enforcement Action: In addition to the penalty, the Income Tax Department has the authority to take further enforcement actions. This may include demanding additional tax payments or initiating legal proceedings against the taxpayer.

It is crucial for taxpayers to understand the importance of filing Form 15CA and Form 15CB in a timely and accurate manner. By doing so, they can avoid penalties, legal complications, and ensure compliance with the tax regulations established by the Income Tax Department.

To ensure that you fulfill your tax obligations and prevent any adverse consequences, it is recommended to seek guidance from a qualified tax professional who can provide the necessary assistance and help you navigate the complexities of Form 15CA and Form 15CB.

Remember, adhering to the tax regulations not only protects you from penalties but also contributes to a transparent and responsible business environment.

You may read some FAQ’s from income tax website directly here: https://www.incometax.gov.in/iec/foportal/help/statutory-forms/popular-forms/form-15ca-faq

Leave a Reply

You must be logged in to post a comment.