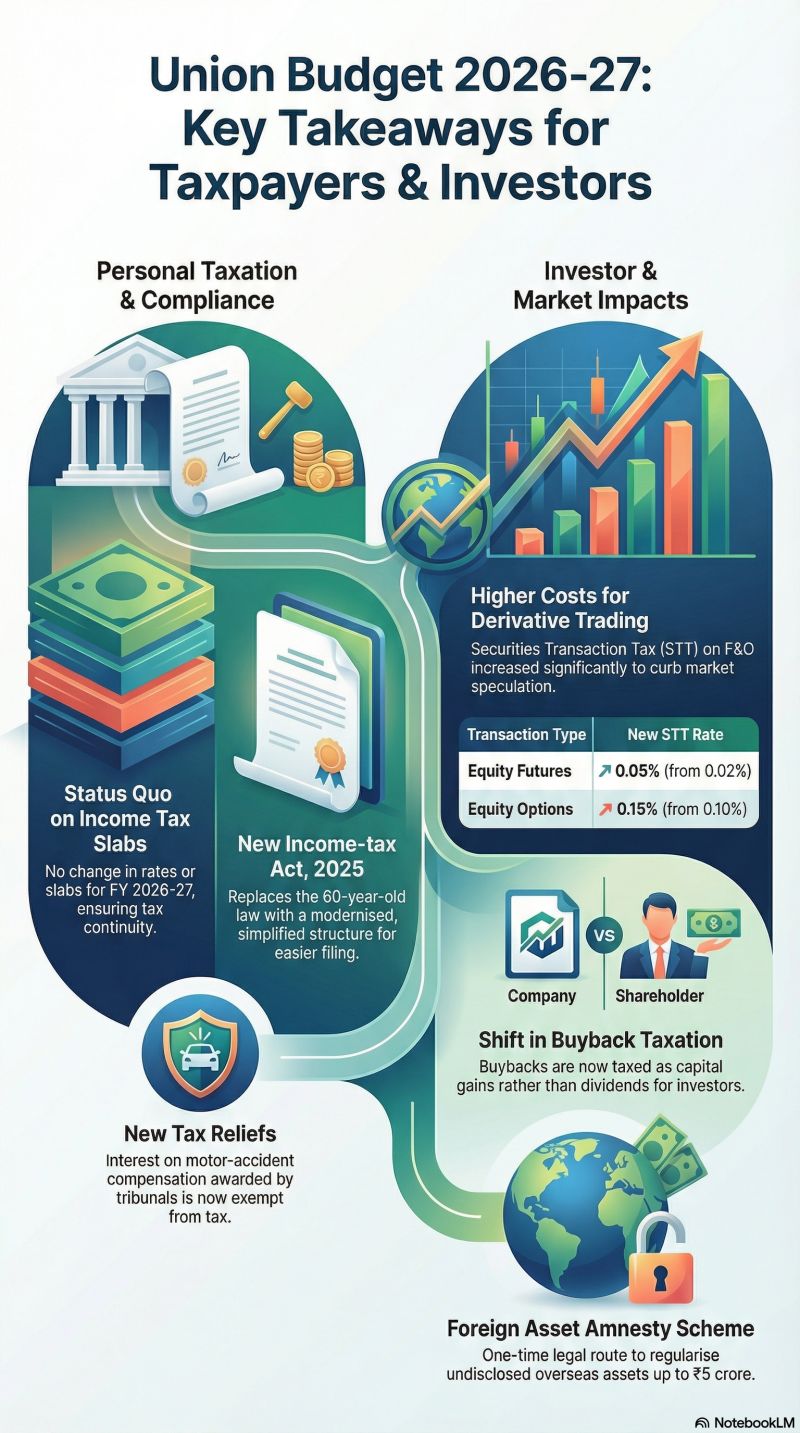

Income Tax

– There is no change in income tax slabs or rates for individuals for FY 2026-27, maintaining the current tax burden. The standard deduction and rebate remain unchanged.

– Implication:Individuals, particularly salaried and resident taxpayers, will experience a neutral tax burden with no rate cuts or slab expansions. Compliance is expected to simplify under the new tax code.

Capital Gains & Investments

– Buybacks will now be taxed under capital gains at slab rates, increasing effective tax liability for promoters and certain investors.

– Impact: Investors holding stocks for buybacks may face higher tax liabilities based on their holding patterns, with no relief on capital-gain rates announced.

Securities Transaction Tax (STT)

– The STT on equity derivatives has been increased:

– Futures: 0.05% (up from 0.02%)

– Options: 0.15% (up from 0.10%)

– Impact: This increase raises costs for traders active in futures and options, reducing net returns for frequent traders.

Foreign Assets & Compliance

– A one-time amnesty for undisclosed foreign assets (up to ₹5 crore) is introduced through a simplified regularization scheme with capped payment obligations.

Continue Reading here

Recent Posts

- Key takeaways for taxpayers and investors – Union budget 2026-27

- GST Cut on Notebooks – But Why Aren’t Prices Dropping?

- FAQs on TAX DEDUCTED AT SOURCE (TDS) under GST

- Don’t Get Tricked! When and how to appoint First Auditor after registering company?

- Important Tax Updates for NRIs and OCI Card Holders Buying and Selling Property in Goa