-

OCI card holder and participation in Indian business — a regulatory perspective…

Applicability of FEMA and FDI provisions depends on specific facts and structure; the above is for general awareness and not a legal opinion.

-

A forgotten foreign bank account can lead to a penalty of ₹10 lakh per year.

A forgotten foreign bank account can lead to a penalty of ₹10 lakh per year. […]

-

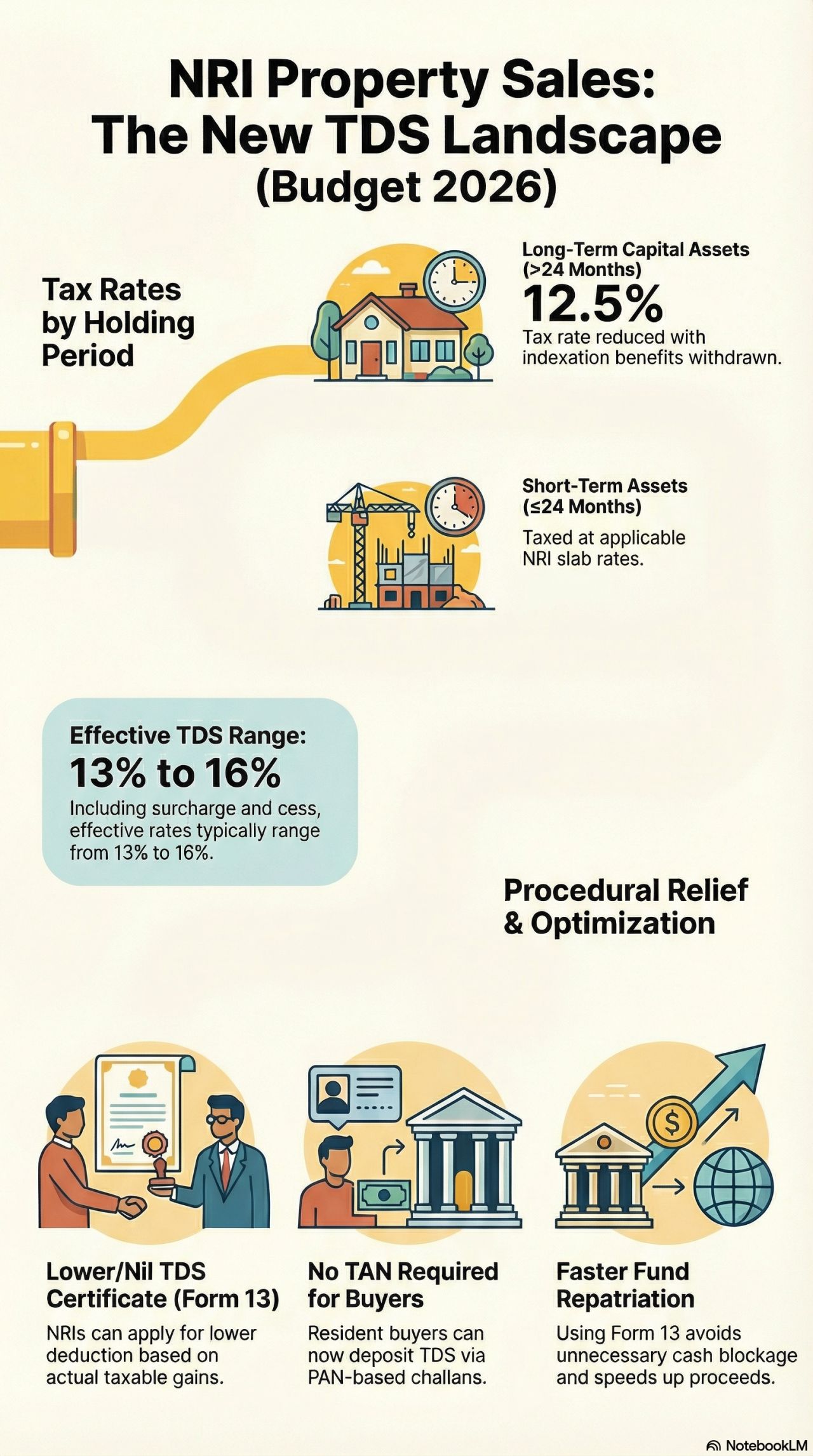

Why Budget 2026 Replaced TAN with PAN for TDS on NRI Property Sales

Earlier, resident buyers purchasing property from NRIs had to obtain a TAN only for one transaction, file TDS returns, and manage complex compliance. This resulted in: Procedural difficulty Delays in property transactions Penalties for technical defaults

-

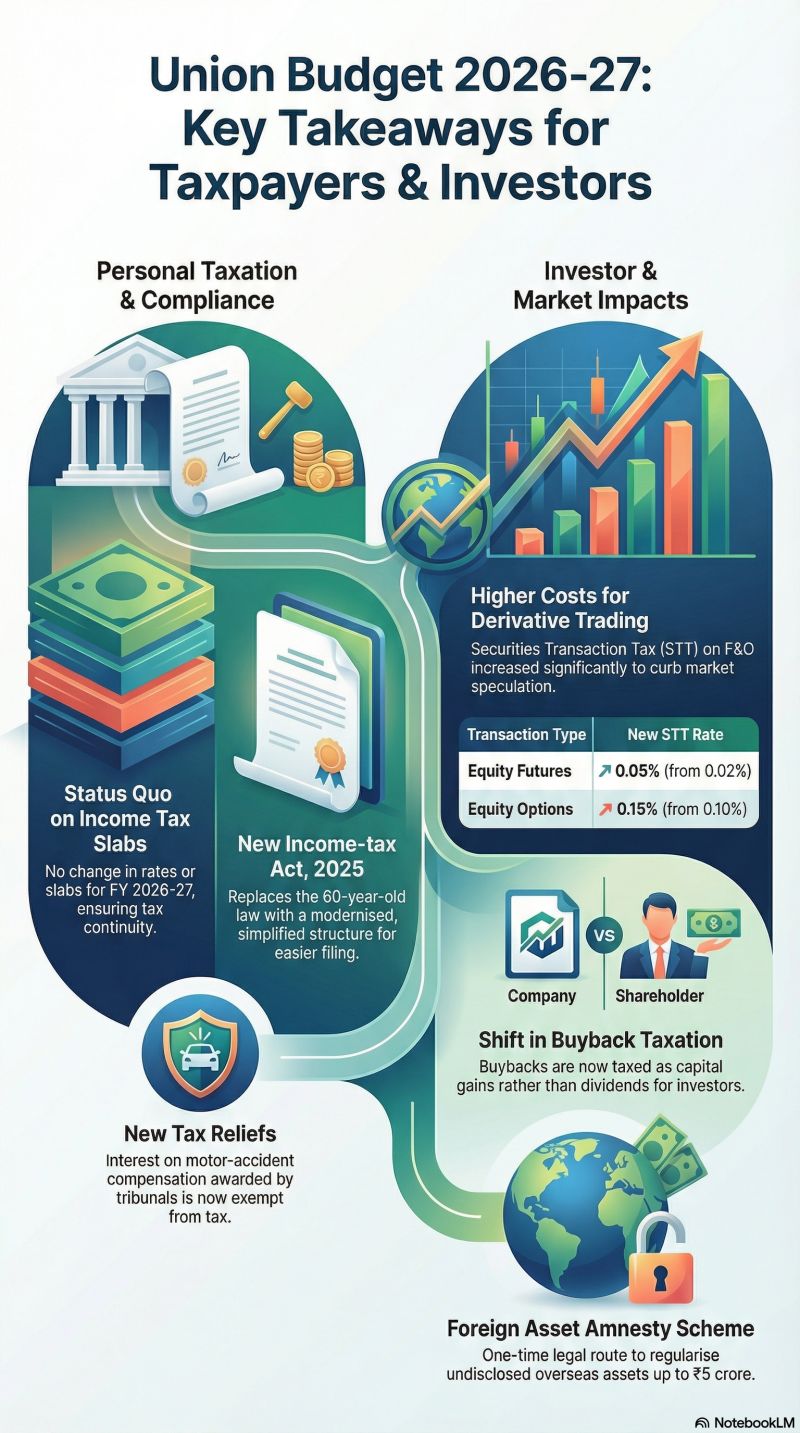

Key takeaways for taxpayers and investors – Union budget 2026-27

Key takeaways for taxpayers and investors – Union budget 2026-27 | – There is no change in income tax slabs or rates for individuals for FY 2026-27, maintaining the current tax burden. | Capital Gains & Investments – Buybacks will now be taxed under capital gains at slab rates, increasing effective tax liability for promoters…

-

GST Cut on Notebooks – But Why Aren’t Prices Dropping?

The GST Council recently made school notebooks to be charged 0% GST (from 22nd Sept […]

-

-

Don’t Get Tricked! When and how to appoint First Auditor after registering company?

Congratulations on your new OPC, Pvt Ltd, or LLP! But beware of online portals pushing immediate auditor appointments and ADT-1 filing. This is NOT mandatory! Our guide empowers you to appoint your first auditor on YOUR terms, saving you time, money, and unnecessary burdens. Learn how to take control of your finances and focus on…

-

Important Tax Updates for NRIs and OCI Card Holders Buying and Selling Property in Goa

This blog post focuses on recent amendments affecting Non-Resident Indians (NRIs) and Overseas Citizenship of India (OCI) card holders buying and selling property in the state. We’ll delve into tax implications, income tax return filing processes, and the importance of voluntary compliance.

Ponda, Goa, India

9:30AM – 6PM

enquiry@camanisha.com