-

A forgotten foreign bank account can lead to a penalty of ₹10 lakh per year.

A forgotten foreign bank account can lead to a penalty of ₹10 lakh per year. […]

-

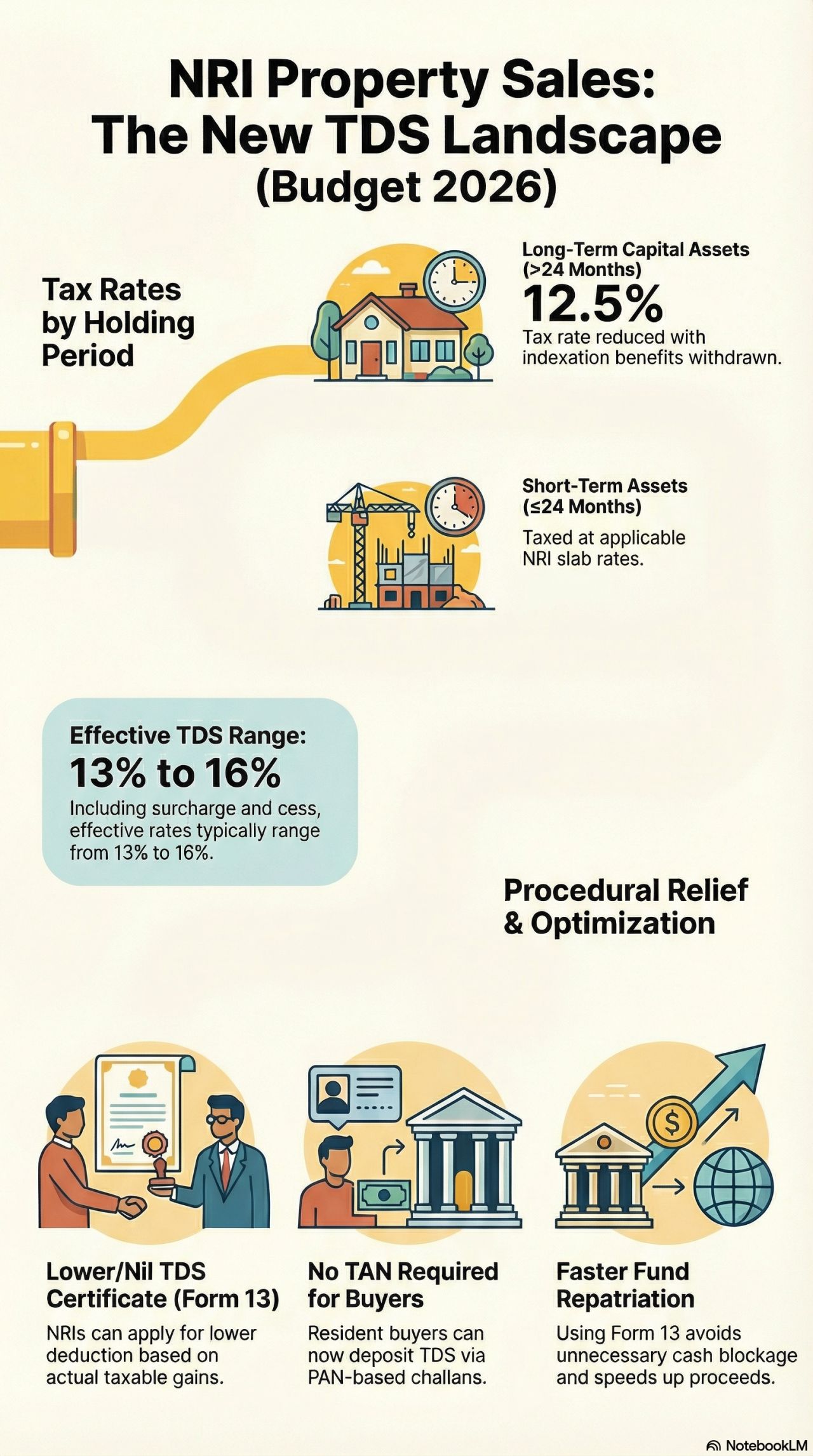

Why Budget 2026 Replaced TAN with PAN for TDS on NRI Property Sales

Earlier, resident buyers purchasing property from NRIs had to obtain a TAN only for one transaction, file TDS returns, and manage complex compliance. This resulted in: Procedural difficulty Delays in property transactions Penalties for technical defaults

-

Important Tax Updates for NRIs and OCI Card Holders Buying and Selling Property in Goa

This blog post focuses on recent amendments affecting Non-Resident Indians (NRIs) and Overseas Citizenship of India (OCI) card holders buying and selling property in the state. We’ll delve into tax implications, income tax return filing processes, and the importance of voluntary compliance.

-

Countries Covered under DTAA: How TRC Can Help NRIs Avoid Taxation in Ponda, Goa, and Pune, Maharashtra

The Double Taxation Avoidance Agreement (DTAA) serves as a crucial tool for Non-Resident Indians (NRIs)

-

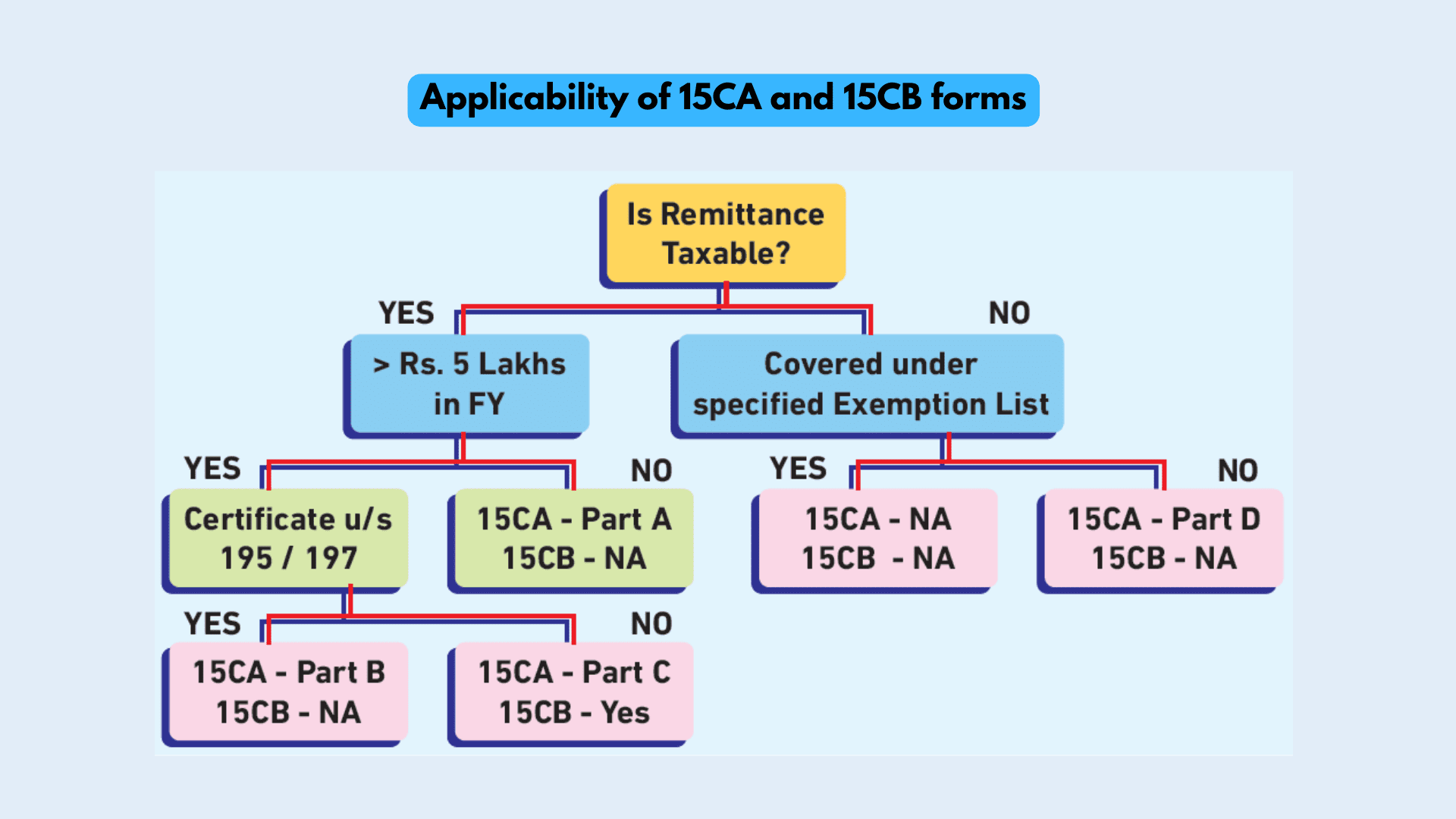

What is Form 15CA and 15CB? Why Do NRIs Need Them?

When NRIs remit money from India, it is essential for them to comply with the regulations set forth by the Foreign Exchange Management Act (FEMA). One of the key compliance requirements is filing Form 15CA and obtaining Form 15CB

-

Who Requires Tax Residency Certificate (TRC)?

Understanding the importance of tax benefits under the Double Taxation Avoidance Agreement (DTAA), NRIs are required to obtain a Tax Residency Certificate (TRC) from the tax authorities of their resident country.

Ponda, Goa, India

9:30AM – 6PM

enquiry@camanisha.com

Recent Posts

- OCI card holder and participation in Indian business — a regulatory perspective…

- A forgotten foreign bank account can lead to a penalty of ₹10 lakh per year.

- Why Budget 2026 Replaced TAN with PAN for TDS on NRI Property Sales

- Key takeaways for taxpayers and investors – Union budget 2026-27

- GST Cut on Notebooks – But Why Aren’t Prices Dropping?