-

Filing a income tax return? Don’t forget to mentions this to your CA.

To maximize tax savings and minimize scrutiny from the income tax department, do disclose these things to your Chartered Accountant for that, while filing your income tax return he or she can help you in the best possible way.

-

Deductions you can claim for costs incurred when calculating capital gains

You didn’t know this, did you? Here are the deductions you can claim for costs incurred when calculating capital gains for tax purposes, explained in simple language with real-life examples:

-

Things that can reduce your capital gains.

When calculating income tax on capital gains in India, there are several avenues available to reduce the taxable income. Here are the points that denote these avenues:

-

Income Sources for Taxpayers in India: A Comprehensive Checklist

Income Sources for Taxpayers in India. Know Your Income Sources: A Comprehensive Guide for Indian Taxpayers.

-

Make Informed Decisions: Key Factors for Salaried Employees in Goa and Pune to Consider When Choosing the Income Tax Regime

As the financial year comes to a close, salaried employees in Goa and Pune must make a well-informed decision regarding the selection of their tax regime.

-

In 2023, tax payers need to be aware of this

In 2023, tax payers need to be aware of certain changes and updates when filing their Income Tax Return (ITR). Staying informed about these changes is crucial to ensure accurate filing and maximize available benefits and deductions.

-

Countries Covered under DTAA: How TRC Can Help NRIs Avoid Taxation in Ponda, Goa, and Pune, Maharashtra

The Double Taxation Avoidance Agreement (DTAA) serves as a crucial tool for Non-Resident Indians (NRIs)

-

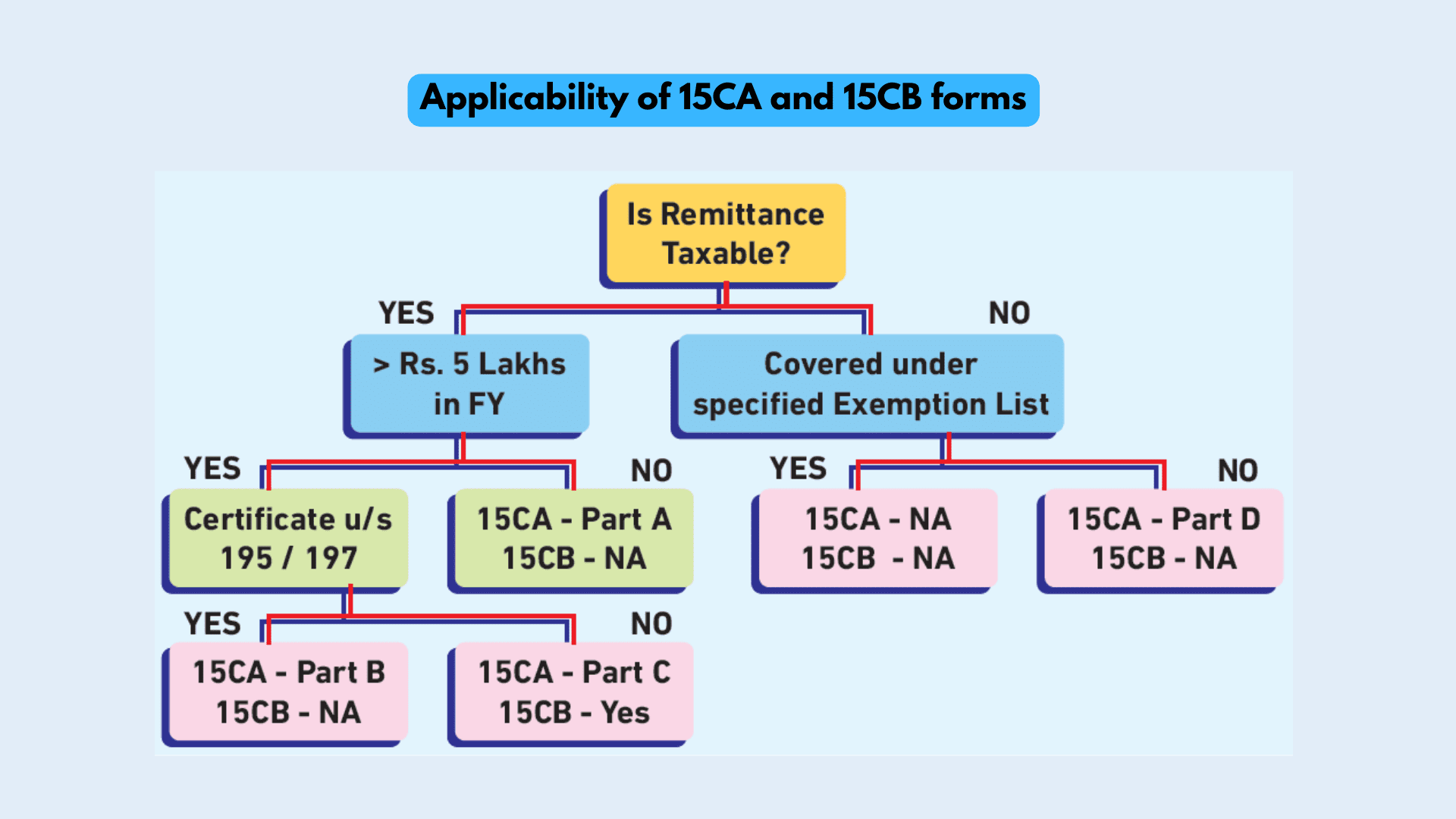

What is Form 15CA and 15CB? Why Do NRIs Need Them?

When NRIs remit money from India, it is essential for them to comply with the regulations set forth by the Foreign Exchange Management Act (FEMA). One of the key compliance requirements is filing Form 15CA and obtaining Form 15CB

Ponda, Goa, India

9:30AM – 6PM

enquiry@camanisha.com