-

Unlocking Income Tax Secrets: Your Guide to Navigating Gifts from Relatives!

Unlocking Income Tax Secrets: Your Guide to Navigating Gifts from Relatives!

-

Ticking Clock! File Your FY 2022-23 Income Tax Return Before December 31st (Avoid Tax Time Tears!)

The clock is ticking, fellow taxpayers! If you haven’t filed your income tax return (ITR) […]

-

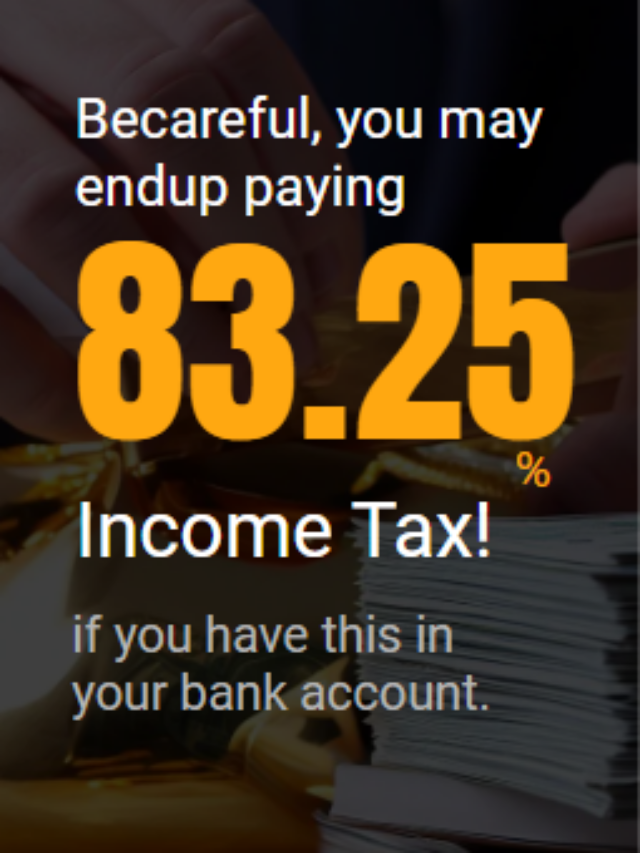

Unexplained cash deposits and income tax

Such unexplained money attracts a high income tax at the rate of 83.25% (60% tax + 25% surcharge+ 6% penalty).

-

How does income tax department track your income and compare it with your income tax return?

If the ITD finds any discrepancies between your income and your income tax return, they may issue you a notice.

-

How to check income tax return and also income tax refund for AY 2023-24 processed or not? How to check status?

How to check income tax return and also income tax refund for AY 2023-24 processed or not? How to check status?

-

5 transactions in cash that can attract an income tax notice

5 transactions in cash that can attract an income tax notice.

-

5 Tips to Avoid Income Tax Notices for Property-Related Transactions

If you are planning to buy, sell, or gift property in Goa, it is important to be aware of the income tax implications. By following these 5 tips, you can avoid income tax notices and penalties:

-

Top Five Reasons Why Filing Income Tax Returns within the Due Date is Crucial

Filing Income Tax Returns (ITR) on time is important for taxpayers in Goa to avoid penalties and fines, interest on tax amounts due, and to avail various benefits such as revising returns and carrying forward losses.

Ponda, Goa, India

9:30AM – 6PM

enquiry@camanisha.com