-

Aadhaar-PAN Link: PANs of 10 crore NRIs became inactive?

The department has emphasized that the inoperative status of PANs does not render them inactive and affirms that affected taxpayers can continue filing their Income Tax Returns (ITR) without disruption. However, they will face higher tax deduction at source and will not get refunds until they update their residential status with the department.

-

IT notices for salaried

5 critical reasons why salaried people in India can get income tax notices in 2023-24

-

Things that can reduce your capital gains.

When calculating income tax on capital gains in India, there are several avenues available to reduce the taxable income. Here are the points that denote these avenues:

-

How to Avoid Heavy Penalties by Filing TDS Returns on Time

As a business owner, it is essential to file your TDS returns on time to avoid heavy penalties and fees. Failing to file the TDS return can result in unwanted notices and demands from the income tax department, forcing you to pay hefty fines and fees. In this article, we will provide you with an…

-

Thinking of buying property? Read this

According to the Income Tax Act, if you are buying immovable property other than agricultural land, and amount to be paid is more than Rs.50 lakh, then you have to deduct 1% TDS

-

Auditing Assurance Services

Statutory Audits – Ensuring Compliance with the Law As a business owner, you may have […]

-

6 cases when TDS on Property is Not Applicable

As per this section, any person who purchases immovable property from an Indian resident is required to deduct TDS

-

Deductions you can claim for costs incurred when calculating capital gains

You didn’t know this, did you? Here are the deductions you can claim for costs incurred when calculating capital gains for tax purposes, explained in simple language with real-life examples:

-

Sanquelim, Goa Branch

Introducing our Sanquelim Branch: Empowering Businesses and Fostering Financial Literacy Welcome to the Sanquelim branch […]

-

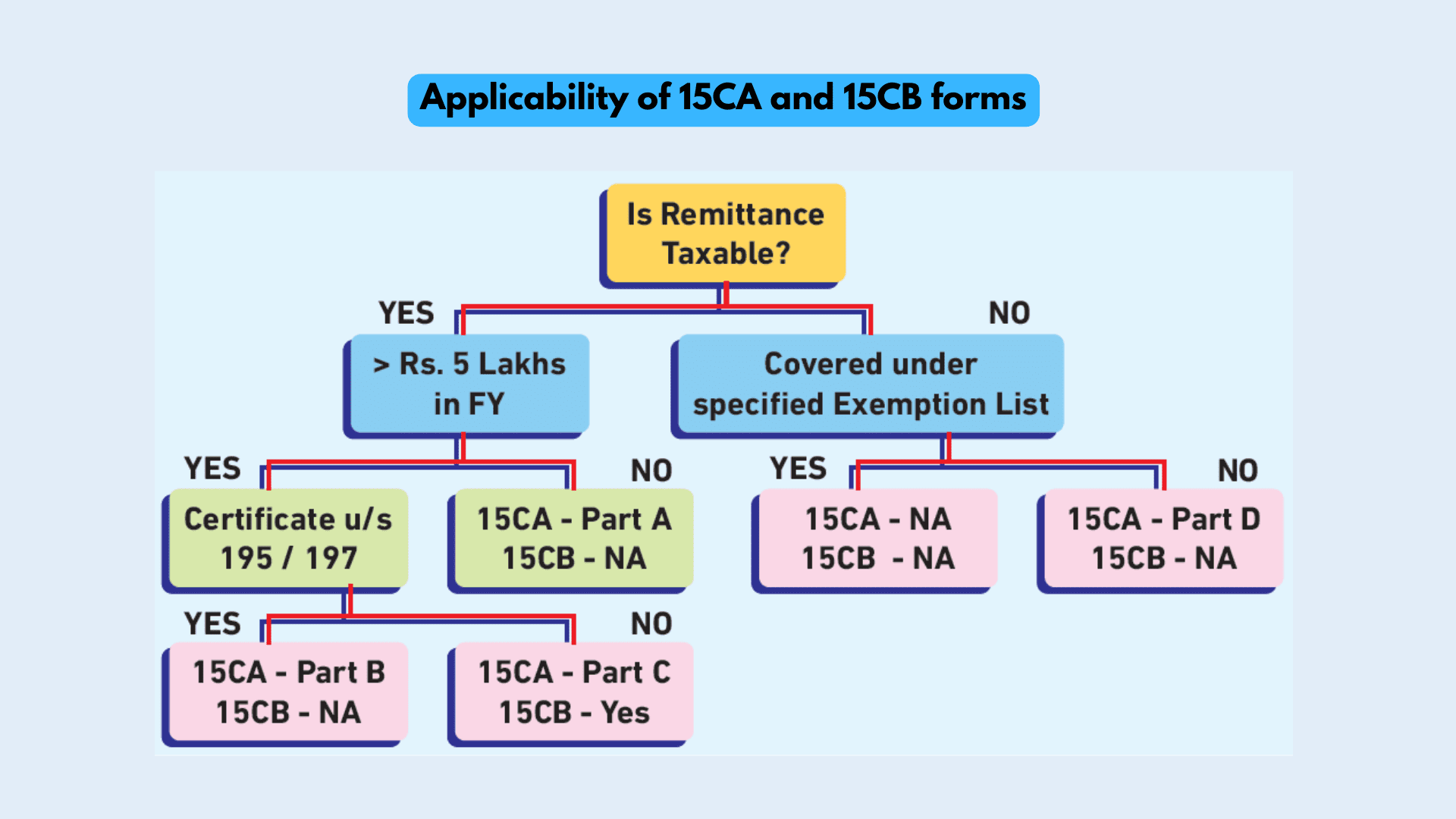

What is Form 15CA and 15CB? Why Do NRIs Need Them?

When NRIs remit money from India, it is essential for them to comply with the regulations set forth by the Foreign Exchange Management Act (FEMA). One of the key compliance requirements is filing Form 15CA and obtaining Form 15CB

Ponda, Goa, India

9:30AM – 6PM

enquiry@camanisha.com